From breakfast foods to automobiles, there has been a decline in demand for certain products in the US market. The decline has been affected by economic factors, environmental concerns, and technological advancements. This post delves into 20 such products, exploring the reasons behind their decreasing popularity to understand how these trends are playing out across different segments of the market.

Cereal

The U.S. cereal market’s valuation is projected to be $13.57 million in 2023. Despite innovative health-driven products, traditional cereal brands are struggling to maintain their market share due to shifts towards quicker and more nutritious breakfast options. Detailed market trends are available from Mintel’s comprehensive 2023 report.

Soda

In 2023, the global soft drinks market, including sodas, reached a value of $464.88 billion, growing modestly. However, within this sector, soda specifically faces declines driven by health trends and the rising popularity of alternative beverages like flavored waters and teas. Yahoo Finance covers these shifts in a recent market report.

Gum

Chewing gum sales have declined over the years, potentially influenced by increased competition from mints and candies. This gradual decrease highlights a consumer shift towards sugar-free options and alternative oral care products. Statista provides an in-depth analysis of these trends.

Guns

There has been a recent decline in gun sales, sometimes significant. This decline can be attributed to several factors. Firstly, there is little likelihood of new gun control measures, which reduces the incentive for enthusiasts to make additional purchases. Secondly, it appears that most individuals who intended to buy guns in the past few years have already done so. For instance, in the first quarter of 2014, Sportsman’s Warehouse, a retail chain specializing in guns and ammunition, experienced an 18% drop in comparable store sales, while Cabela’s saw a 22% decrease in gun sales.

Frozen Meals

The frozen food sector saw an increase in total sales, yet specific segments such as frozen meals experienced a decline in unit sales in 2023, attributed to changing consumer preferences towards fresher, healthier options. Food & Beverage Insider details these market dynamics.

Fruit Juice

The U.S. juice market is expected to achieve slow growth, with projections showing a market volume of $13.9 billion by 2028. This stagnation reflects concerns over high sugar content and a consumer pivot towards whole fruit and vegetable juices. Statista offers a detailed forecast of these trends.

Soup

The U.S. soup market experienced a 12.3% growth in 2023. This increase is seen in the context of a long-term decrease, possibly reflecting temporary consumer preferences during economic fluctuations. Mintel provides an in-depth look at these developments.

Chef Boyardee

Sales for Chef Boyardee have been declining as the brand grapples with changing consumer tastes away from processed foods. The overall sales for its parent company, Conagra, missed expectations in 2023, underlining struggles in the packaged food sector.

Razors

The razor market has continued to experience downturns with the rise of beard culture and the increasing popularity of electric shavers. Brand loyalty remains high among certain leading brands despite a general market contraction.

Bread

Bread faces ongoing challenges due to evolving consumer preferences, particularly toward healthier alternatives such as gluten-free and low-carb bread options. These changing preferences reflect a broader trend toward wellness and dietary consciousness among consumers. As a result, traditional bread manufacturers are increasingly diversifying their product offerings to cater to these shifting demands, while also exploring innovative approaches to maintain their market share.

Convertibles

Convertible cars, once symbols of freedom and summer fun, are becoming less common as the auto industry focuses more on electric cars and sturdy SUVs. Sales of traditional convertibles like the Chevrolet Camaro and Ford Mustang, as well as smaller ones like the Mazda Miata, have dropped sharply in the United States. S&P Global Mobility now sells fewer than 100,000 units annually. This is a significant decrease from the peak of almost 320,000 vehicles, which accounted for 2% of all new U.S. vehicle sales, in 2006, and about 144,200 vehicles, or 0.8%, in 2015.

Houses

Home sales have fluctuated significantly, with a notable decrease in first-time homebuyer activity due to rising prices and interest rates. Economic uncertainty, demographic shifts like millennials delaying homeownership, limited housing inventory, a growing preference for renting, tighter lending standards post-2008, and the COVID-19 pandemic’s economic disruptions collectively contribute to the decrease in homebuying activity.

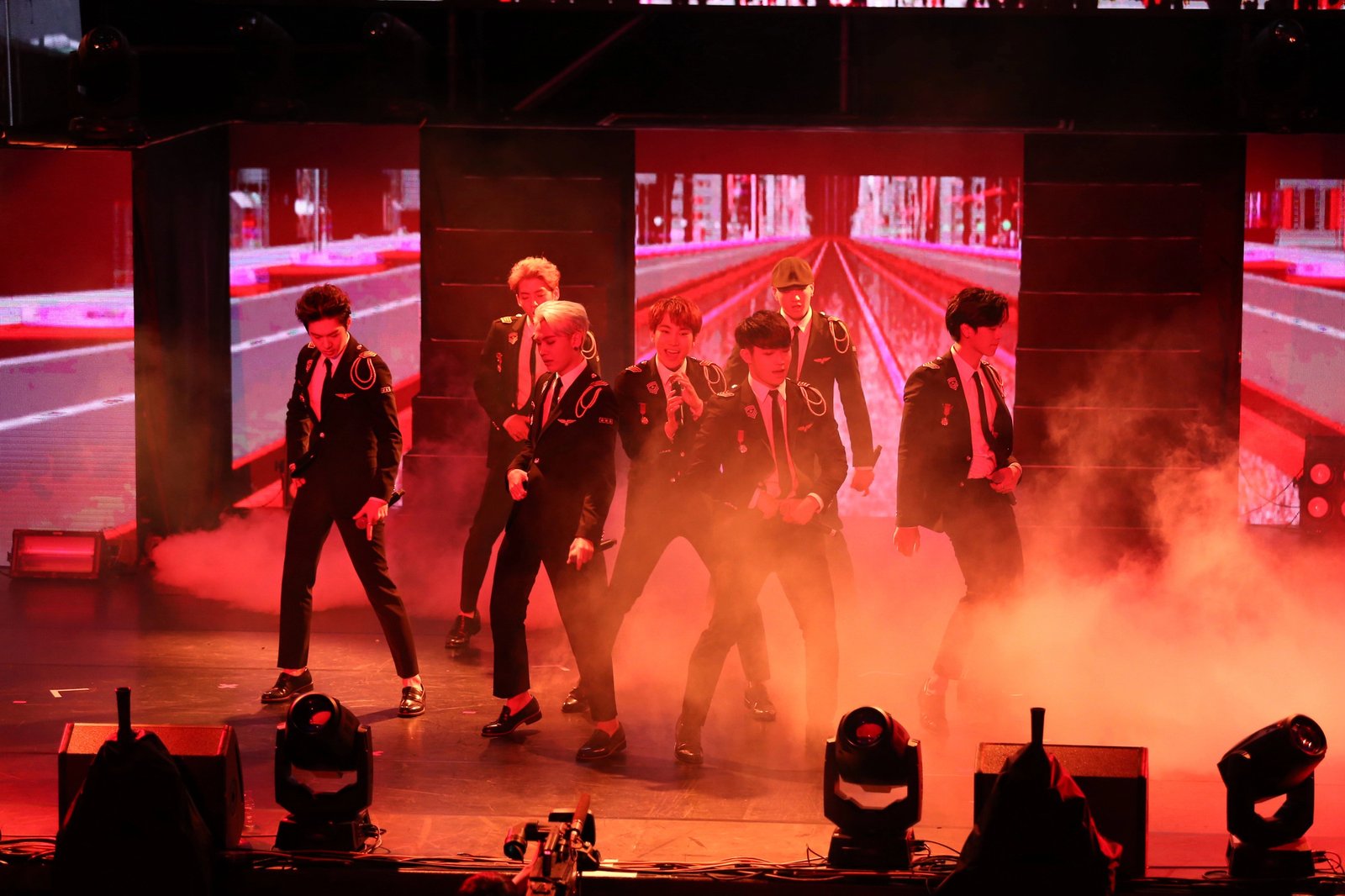

Concert Tickets

The cost of attending live music events has become prohibitive for many, with tickets often exceeding $100, plus additional fees. This has reduced the frequency with which people attend such events, especially among budget-conscious demographics.

Cars

The auto industry has seen a shift as consumers hold onto their vehicles longer due to rising costs and a more challenging economic climate. The average car payment has reached record highs, deterring new car purchases.

Mani/Pedis

Luxury personal care services like manicures and pedicures are among the first discretionary expenses to be cut during economic downturns. This reflects a broader reduction in spending on non-essential services.

Meat

High meat prices have forced consumers to seek cheaper protein alternatives like beans and lentils. Even less expensive cuts of meat have become too costly for many families.

Dental Work

Due to rising healthcare costs, many are postponing or avoiding necessary dental treatments, opting to endure discomfort rather than incur the high cost of dental care.

Home Improvements

Inflation has also affected the home improvement sector, with many delaying or downsizing projects due to increased material and labor costs.

Dining Out

Rising food and service costs have made dining out less appealing, with many opting to cook at home to save money. This trend is particularly pronounced among middle-income families.

Travel

Economic constraints and rising travel costs have led to a reduction in both domestic and international travel. Many are prioritizing essential spending over vacationing.