Imagine living in a country where you can maximize your savings by not having to pay taxes. This isn’t a fantasy; it’s the reality of tax-free havens around the world. You may be a freelancer with a laptop and a dream. Or, a business owner seeking growth. Or, simply someone yearning for a tax-free lifestyle. These destinations offer a compelling alternative. However, it’s important to note that there is no such thing as a truly tax-free country. All countries have some form of taxation, even if it is not income tax. For example, many tax-free countries have sales taxes or property taxes. In this article, let’s discover the most popular tax-free countries around the world.

Even before learning about tax-free countries, it’s crucial to know how to choose the right one. It must align with your goals.

Here is the list of the most popular tax free countries around the globe.

United Arab Emirates (UAE)

The UAE is a federation of seven emirates, each with its own ruler. It’s a thriving hub for expatriates and entrepreneurs. It offers economic stability and a great location. The UAE has no income tax for individuals, and there are also no taxes on corporate profits, capital gains, or inheritance. However, there is a 5% value added tax (VAT) on most goods and services. Residency in UAE is possible through various visa options, such as investor visas or retirement visas.

Bahrain

Bahrain is a financial center. It has a growing expatriate community. This provides opportunities for business and leisure. It offers tax-free living with no personal income tax or corporate tax. However, Bahrain has a social security system. Citizens contribute 7% of their income, while expats contribute 1% to it. Most goods and services have a 10% VAT applied to them. Bahrain also has property transfer taxes, excise taxes on certain goods, and levies on hotels and restaurants. Residency is possible through either employment or investment, with relatively straightforward visa processes.

Oman

Oman imposes no personal income tax on residents. It’s known for its natural beauty, rich culture, and welcoming atmosphere. This makes it attractive to expatriates. However, there are some taxes in Oman to be aware of: corporate income tax, 10% withholding tax, and custom duties on imported goods. Residency is possible through employment sponsorship or investment in property or business.

Qatar

Qatar offers a high standard of living. It has modern amenities and business opportunities. These are in industries such as oil and gas, finance, and technology. It has no personal income tax for residents. However, some taxes are different. For example, there is a 10% corporate tax (with exceptions). There is also a withholding tax and an excise tax on goods like tobacco or sugary drinks. And, there are customs duties on imported goods. Residency is possible through employment sponsorship or property investment.

Cayman Islands

The Cayman Islands are a British Overseas Territory located in the Caribbean Sea. It’s a renowned offshore financial center with a stable political and legal environment. It has no direct taxes, including no income tax, corporate tax, or capital gains tax. However, there is a stamp duty of 1.2% on the transfer of real estate. Residency is possible through investment in real estate or business.

Monaco

Monaco is a city-state located on the French Riviera. Monaco is a popular tourist destination and a playground for the rich and famous. It’s a glamorous destination known for its luxury lifestyle, safety, and favorable tax policies. Monaco does not levy personal income tax on its residents. There are also no taxes on capital gains, inheritance, or wealth. However, there is a value added tax (VAT) of 20% on most goods and services. Residency is possible through various routes, including employment, investment, or family ties.

Bermuda

Bermuda is a British Overseas Territory located in the North Atlantic Ocean. It is a pretty island nation. It has a thriving international business sector. It also has a lively expatriate community and is a popular tourist spot. It is also a major offshore financial center. There are no income taxes, corporate tax, capital gains taxes, or inheritance taxes in Bermuda. However, there is a payroll tax of 6.5% for employers and 5.5% for employees. Residency is possible through investment in real estate or starting a business.

Bahamas

The Bahamas is a chain of islands in the Caribbean Sea. It offers a tropical paradise with pristine beaches, clear waters, and a relaxed lifestyle. It is a popular tax haven for the rich. There are no income, capital gains, or inheritance taxes. However, there is a sales tax of 12% on most goods and services. Residency is possible through investment in real estate or financial independence.

Isle of Man

The Isle of Man is a self-governing British Crown dependency with a strong economy and attractive lifestyle. It is a tax haven for residents and businesses. Residents pay a low income tax (10% or 22%) with a tax-free allowance. Businesses enjoy a 0% corporate tax rate. There are no taxes on capital gains, inheritance, or wealth. Residency is possible through various routes, including employment, investment, or retirement.

British Virgin Islands

The British Virgin Islands is a British Overseas Territory in the Caribbean Sea. It has beautiful beaches and a relaxed atmosphere. It is a tax haven ideal for businesses. It offers a 0% corporate and capital gains tax rate. It is attractive for setting up a company and investing. There’s a payroll tax for employees earning over $10,000 annually, but other taxes like stamp duty are minimal. Residency is possible through employment or investment.

Turks and Caicos Islands

A British Overseas Territory located in the Atlantic Ocean, north of the Dominican Republic and Haiti. Beautiful beaches surround it and offer world-class diving and snorkeling activities. Turks and Caicos Islands have no income tax, capital gains tax, or inheritance tax. However, there are some indirect taxes, like import duty and the National Health Insurance Plan. These taxes raise living expenses. There are other smaller taxes like property taxes and registration fees as well. Residency is possible through employment or investment.

How to Choose the Right Tax-Free Country

Choosing the right tax-free country is a critical decision. Take time to think about what your goals are. Whether you want more money for yourself, or you want international business opportunities, or you want to have a more quality life. No matter what the intention is, knowing it clearly will help you choose the right country.

Next, research about different tax-free countries. Look at their tax laws, legal systems, and how stable their economy is. Find countries with no income taxes, low business taxes, and transparent laws that meet your needs. Ask an international tax and immigration lawyer. Also, ask a financial advisor. Get personalized guidance on tax planning and residency rules. It helps in making the process smoother. By doing your research, planning carefully, and getting help from experts, you can confidently choose a tax-free country. This way, you’ll be making an informed decision.

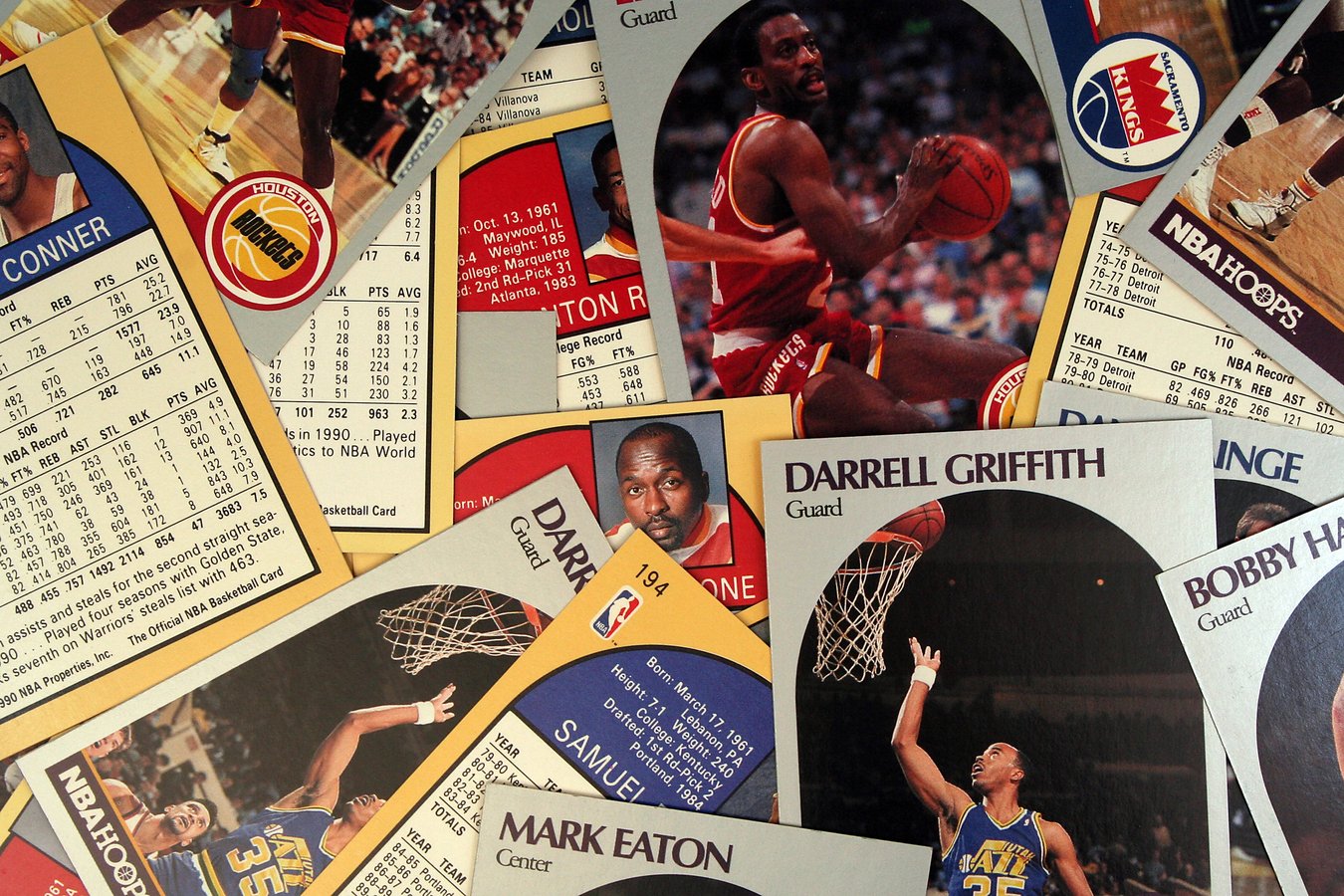

More From The Kanso – 20 Things In Your House That Could Be Worth A Fortune

Imagine throwing away the antique furniture without knowing its worth or the card set that your dad collected but is now worth millions. Keep reading if you are curious about such underrated items that can be worth millions.

17 Job Interview Phrases to Absolutely Avoid (and What to Say Instead)

Interviews are an opportunity for both employees and employers to learn more about each other. However, as a jobseeker, one wrong move can take away that dream job. Here are 17 things you should avoid saying or asking during a job interview.